Chapter 4: What does London have to offer?

London’s status as an HQ city is impressive, and the city’s HQ economy brings great benefits, as shown in previous chapters. But what makes London such an attractive location for head offices and head office functions – and is this position guaranteed to continue in the future?

London as a leading city

Recent years have seen London settle into a fairly entrenched position at the top table of global cities. Since 2015, JLL has been compiling numerous different “city competitiveness” indices created by consultants, advisers and academics around the world. London was at or near the top of most rankings. 105 In 2017, London was ranked the number one world city across 44 different indices, including strong showings in the areas of infrastructure, transparency and talent. 106

Are people London’s next infrastructure challenge?

Real estate advisor

But this success is not guaranteed. The cost of living presents a significant risk to London’s offer to talented workers. Affordability is also a significant risk to London’s offer to talented workers. The availability of affordable housing, particularly for new graduates, was mentioned as a major challenge in the vast majority of interviews for this report. And London’s affordable housing problem has only worsened in recent years: the ratio of median house price to median earnings widened from 8.5:1 to 13:1 over the last ten years. 107

Infrastructure is also lagging behind growth. Crossrail is yet to open, airport expansion is still in the planning stage, and international investors perceive a decline in – or a failure to improve – the UK’s transport and logistics infrastructure. 108 But what are those tasked with making HQ location decisions most concerned about today?

The 20 “pillars” and the future

The previous chapter introduced the 20 pillars of HQ city attractiveness. London has all of these 20 factors in place, but some rest on firmer foundations than others. The weakening of a limited number of these pillars may lead to some instability, but no collapse in London’s overall position. However, a tipping point clearly exists, whereby damage to too many would lead to collapse.

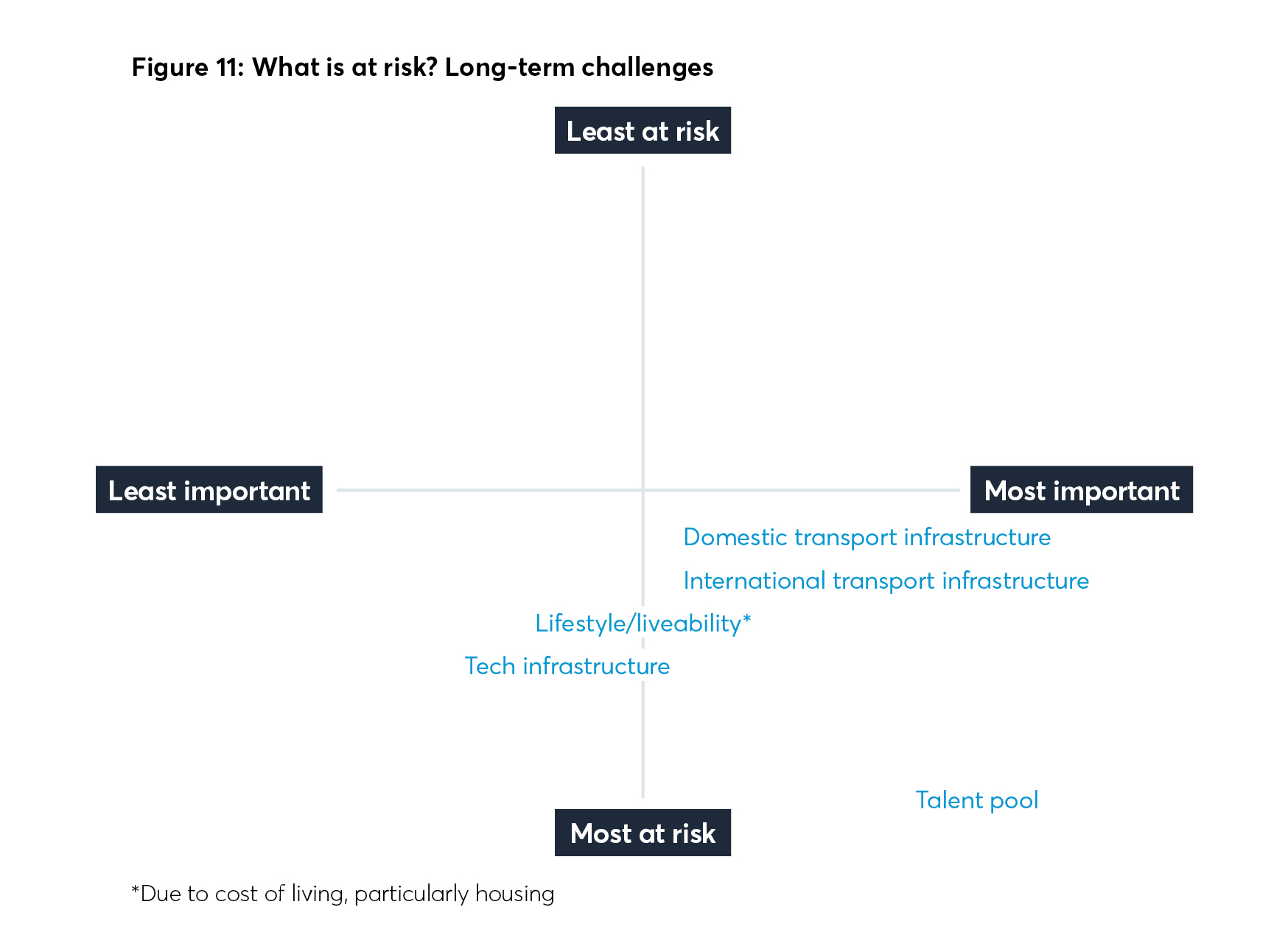

In addition, some pillars bear more weight than others, and are therefore more vital to London’s attractiveness. Some are also connected, with their success or failure particularly intertwined with that of others, as the diagram in the previous chapter illustrated. Whilst all 20 factors are important in making London an attractive and successful HQ city, Figures 10, 11 and 12 attempt to rank the relative importance of different factors to London’s continued success. Subsequent graphics evaluate which factors are more “at risk” of being compromised, and whether these represent acute or chronic challenges for London.

London’s top challenges for HQs:

- Talent pool: London’s great specialism, but being put at risk due to cost of living, the failure to build enough housing, and the failure to update transport infrastructure to unlock more housing opportunities. In the shorter term, London’s talent pool is at risk due to changing attitudes/policies towards immigration.

- Liveability: A strongly related point – at risk due to affordability issues.

- Infrastructure: Whilst transport and tech/digital infrastructure investments are planned, progress is slow and risks are lagging behind international competitors.

- Reputation for internationalism, diversity and tolerance: at risk due to Brexit and the rise of populism

Openness to talent – at risk

Talent is the most important element by an enormous margin (…) we hear this from UK members, foreign members, companies we speak to abroad – that you can be reasonably confident that you can either find the talent you need here, or you can say to your senior executives that they’ll be living in London, and they’ll say “great”.

Financial services sector representative

Whilst London is rated highly for providing access to skilled workers for international business, both London and New York are comparatively poor at upskilling domestic workers (when compared to other world cities). According to JLL: “London and New York’s model relies somewhat more on external talent, and consequently they have a higher share of foreign-born citizens than their peers (35 per cent +)”. 109 Tech sector interviewees for this report were unimpressed by the UK education system’s teaching of digital literacy, observing a “20 year gap at least” that would require significant progress to plug. 110

So London’s attractiveness as an HQ location is reliant on the city’s welcoming, inclusive attitude to immigration. In 2018, EY found international investor perceptions of the UK’s attractiveness to be deteriorating, with over a third of investors expecting things to get worse in the next three years. 111 However, perceptions of London seem to have decoupled from those of its host nation. The same year, Boston Consulting Group surveyed over 300,000 skilled workers in nearly 200 countries around the world on their views of different work locations. They ultimately concluded that, whilst the UK’s international brand had been hit by Brexit, London was able to maintain a distinct and more positive reputation:

From the vantage point of the UK’s appeal, it is probably lucky that it has London (the number one city in the world to move to) […] London’s continued popularity suggests that cities can have different and, in some cases, better brands than the countries they’re in. 112

With the UK’s “brand” declining, London must maintain its welcoming reputation to ensure continued success as a business location, destination for FDI, and ultimately as an HQ city.

Brexit – impact still unclear

Ultimately, our research has suggested that Brexit is by no means the single biggest concern for many of those involved in making HQ decisions. One real estate adviser, reporting the surprising absence of a slowdown in London’s real estate market, hypothesised that “if London was dominated by UK companies, it would be a lot worse. There would be a lot less happening.” 113 Whilst the ongoing uncertainty surrounding the Brexit negotiations feels destabilising for UK residents, for an investor from Singapore or Canada it may appear a temporary blip, relatively minor and time-limited compared to other potential investment locations.

The true impact of Brexit is difficult to discern from the noise surrounding negotiations – and particularly so as the outcome of the process remains to be seen at the time of writing. In addition, as one real estate adviser observed, the ongoing negotiations are incentivising companies to stress their inclination to leave the UK publicly:

You’ve got politics at play – you’ve got perception and reality. Businesses of scale know that if they start to make noises about relocating their HQ functionality, they’ll get attention. [A major international bank] have done it three times in their history, and pre-Brexit […] and the reality is that they’ve never actually followed through on that, but rather they’ve used it – in my view – as a device to get some attention and some sort of audience with decision makers at a higher level. I’d stop short of saying they’ve used to get any sort of inducements or incentives – there’s no evidence for that – but certainly it’s been used as a device to engage at a higher level around their business. And what we’ve got now with Brexit is that whole process on speed. Everybody’s thinking about pressing that political button, talking about the need to relocate. But I don’t believe that you can dismantle 180-200 years of trading history and financial expertise that the City’s accrued overnight. As a business, you just don’t want to be away from that ecosystem, that environment, whatever you want to call it. 114

Real estate advisor

London’s international reputation has created a powerful cluster of businesses from a range of sectors, as well as an equally strong ecosystem of related business services. The scale and diversity of this cluster is such that the highest quality of legal advice, technical expertise and many other services can be accessed easily and at competitive prices. This is not to say that London is invincible – far from it – but that the depth and diversity of its cluster is a notable asset in itself.

I can’t imagine us not being here. Because of our clients, the companies that we invest in. Our HQ will not move. The tax picture no longer incentivises you to move. But what will change is the proportion of our business we do in London.

With technology and telepresence, the head office will become the place of

71 convening, but not the place of doing. If we cannot easily convene here, because of immigration controls, that would be a reason to move. For our HQ the most important is: can you come here easily.Director, large investment bank

Whilst a sudden mass exodus of HQs from London has not yet materialised, and seems unlikely to do so, contingency planning and the gradual relocation of a limited number of functions and jobs has certainly occurred. This number could easily multiply, and contingency plans could begin to be activated, should the reality – or even the perceptions – of the impact of Brexit worsen. With Paris perhaps the only European city on a scale comparable to London, it seems likely that the collapse of London’s HQ city status would occur in a gradual but still painful fashion, with different business sectors draining jobs to particularly relevant cities – rather than the rapid shock of quickly losing HQs to a single European rival. 115

Equally, skilled workers, crucial to business in general but particularly for HQ employment, may start to view London as a less welcoming place to live and work. Yet Brexit is far from the only threat to London’s HQ economy. The cost of living, and particularly of housing, is becoming a major problem. Some companies are even beginning to consider ways to provide their own housing for new employees on graduate salaries. 114 With the HQ economy shifting towards the tech and digital sectors, and these sectors becoming more and more reliant on city centre locations, London must address its affordability issues if it is to remain competitive.